US Housing starts have risen for the first time in the last 3 months...according to a report, housing starts rose to a 555k annual rate (annual rate implies that based on last month's increase, if the same increase is taken for the rest of the year, you'll close the year with 555k number. Its like saying if my revenues for Q1 of this year were 10$, my annual rate of revenue is 40$ ($10*4 quarters)). However, the building permits fell 4% to 530k annual rate.

Let's first start by understanding what "Housing Starts" means...

Housing starts means how many new houses were built, while building permits means how many permits for new houses were taken. If you have to make an estimate of how many new houses will come in near future, then you should look at the building permits data. Housing starts, on the other hand, is a backward looking / post-mortem measure of how much was done.

Let's first start by understanding what "Housing Starts" means...

Housing starts means how many new houses were built, while building permits means how many permits for new houses were taken. If you have to make an estimate of how many new houses will come in near future, then you should look at the building permits data. Housing starts, on the other hand, is a backward looking / post-mortem measure of how much was done.

These data points are usually given high weightage for overall analysis of the economy and markets by analysts world-wide. This should be so, considering the large impact that housing industry has on the markets, and also considering that the entire crisis happened due to excess money being pumped in into the housing sector in US.

Now, I don't see this news as very significant, simply because till about Jun / Jul end, US had extended tax breaks & discounts on housing prices for all new buyers (in an effort to lift / stabilize the housing prices, which was falling from the sky without a parachute). So, a lot of people, to take additional price benefits, bought houses hoping for an arbitrage after the scheme expires. So soon after this period, there was a lull, as demand from future months got pulled into the scheme period itself. By now, some small but real demand is just coming up, and again, its just an "Annual Rate".

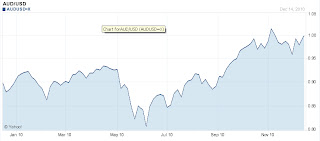

However, and I'm not sure if these two dots can be connected, but I recently read another article about how Australians are buying homes in US ! This has been made possible primarily due to parity between AUD and USD. Suddenly, people from Australia can afford a lot of things from US, which were simply out of reach just a few months back. Take a look at the AUD USD chart below:

The way it has moved in the last few months is a game changing event...and smart (and obviously rich) Australians are lapping up this opportunity...and given the high housing prices in Australia and poor rent / price ratio, this definitely is a good deal.

With some houses on sale / distress sale getting taken up, a jump in new starts is not very surprising. However, just as so many other things, this is also a self-correcting mechanism...if too many such transactions start taking place, USD will appreciate wrt AUD, making it unviable to do this any longer. Besides, USD appreciating against AUD, will also adversely affect US exports to Australia, so its also likely that US will try to put a stop to this by introducing some additional taxes on such transactions.

Its a classic "between a fire and the frying pan" choice - if US restricts these transactions, it keeps its exports up but its housing, which is a bigger problem, gets worse. If it doesn't, exports get hit and the demand doesn't pick-up...which one do you NOT want more is the question here. Take your pick, US !

No comments:

Post a Comment